It’s crazy how time flies. A few more weeks and we’ll be in 2020. Growing up at a time when president APJ Abdul Kalam was going around talking about his vision for India, 2020 was seen as this big year when India would be the shining beacon of growth and prosperity.

Kalam probably knew that much of his lofty vision for the largely poor country wouldn’t come true. But that’s okay. It was something he used to inspire people. Something to aspire to. Like good healthcare for everyone. Bridging the urban-rural divide and so on.

We’ll probably go into all that some other time. But for now, I’d like to draw your attention to my day to day life. In the last couple of weeks, I did some catching up on listening and reading.

Couple of books that I managed to knock off my list are:

👉🏾 Beta China by Hamish McKinzie: It’s one of the few books that show a lot of foresight. The book, published sometime in 2013, points out trends shaping up in China (tech mostly) that soon became part of mainstream discourse in the US and later in India.

👉🏾Little Rice by Clay Shirky: This is another book on China tech that outlines the progress made by Xiaomi and also contextualizes China’s growth really well. I loved the bits where Shirky, in a seemingly effortless way, connects the dots for the reader.

I also finished a couple of podcasts. I highly recommend

👉🏾Land of the Giants from Recode is about tech giants like Amazon. It’s a super deep dive into these companies. For instance, the series on Amazon looks at a wide range of topics from anti-competitive practices to Bezos’ uncanny ability to manage the stock market.

👉🏾The secret history of the future: This podcast produced jointly by The Economist and Slate is another favourite of mine. Ths second season started in July and my favourite episode is called “A bug in the system.” Listen to it.

Tweet threads that caught my attention

🔥Adam Keesling’s thread on Blue Apron: Blue Apron IPO'd in June 2017 at a $2bn valuation. Yesterday, it closed at a stock price of $9.01, representing a market cap of just under $120mm. What happened and what can we learn? Here.

🔥Ali Al Salim on Softbank Vision Fund: And Chamath Palihapithia’s quote tweet.

🔥Brianna on leaving Stripe: It’s all about turpentine.

That’s it from my side this week. Ravish has been on a journey of discovery after the first episode of our podcast Use Case aired. What follows is from him.

For those of us, including me, who have wondered how to impress VCs with a pitch deck, here is an episode with Vinit Bhansali from Orios Venture Partners on what makes the perfect pitch. I absolutely LOVED speaking to Vinit on this and learnt a lot.

Vinit has also very kindly agreed to advise/chat up with our listeners. Should you have any questions or need feedback on your fundraising pitch. Reach out to him on LinkedIn.

Related to our last episode on gaming in India: After we published the episode with Ankush Gera, CEO of Junglee Games, lots of interesting stuff happened. One fascinating discovery was a blog post written by the famous Chinese gaming blogger ‘Necromanov’ which was doing the rounds on Chinese internet through September (you can find the original here or Jeffery Ding’s translation here). It caught my attention for a reason.

The blogger speculatively argues (translated) that “the diverging trajectories of China and India in the information revolution was largely due to the outbreak of online games in China in the late 1990s…From Netease, Sohu, and Shanda to Tencent, about half of the large Internet companies in China use games as their main source of income, while other companies share gains from the advertising and distribution fees that game companies pay for traffic.”

We haven’t verified these claims but, at least trend-wise, it is true that gaming is a significant part of the total revenue of the mentioned firms.

What is more interesting is that he believes that because gaming was such a significant part of Chinese technology companies as against their Indian counterparts (which focused on outsourcing services), Chinese developers were able to come up with several features in non-gaming applications that were inspired by games. Specifically, he points out to retention engineering features such as “login rewards, new rewards, rewards sharing, track your points, reward leaderboards -- innovative designs you won't see on Facebook or Youtube.”

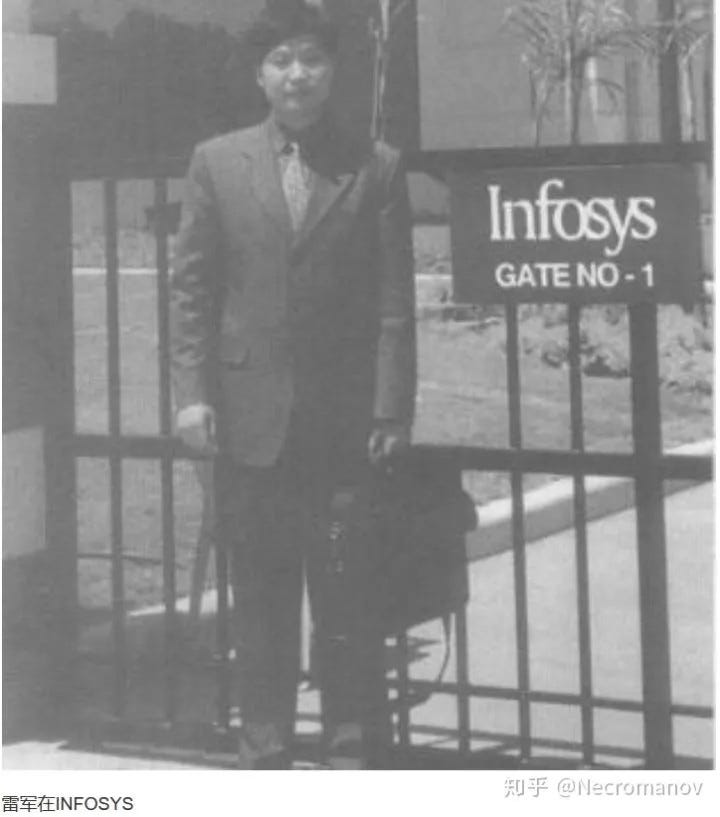

But what was perhaps my favourite finding from the blog post, was this picture of Lei Jun, the founder of Xiaomi (now mostly seen in Jobian attires), while he was a software engineer at Kingsoft and part of a Chinese delegation of IT firms that was sent to India to understand why Indian software companies weren’t as badly hit as the Chinese ones when the dot com bubble burst.

Looking at this picture, I thought about how some of the best founders started their careers before becoming the famed entrepreneurs that we know them to be. I was reminded of Steve Jobs quitting college to join Atari as the abrasive employee no. 40 where he built Touch.me before leaving for India on his now-famous “spiritual research”.

By tech history standards, could one say that gaming had some role to play behind one of the most successful technology companies in Silicon Valley? Maybe not. But I just wanted to point out that connection.

We want to ask our readers some questions – do you think that video game pricing is inelastic? The argument goes that demand will remain the same even if prices are increased because gaming users are hooked.

This gets interesting because in the US, for more than a decade the price of console games has been sticky at exactly $60, even though development costs have increased rapidly. However, newer revenue channels have emerged. The Consumerist explains that this is because game manufacturers set a price floor for distributors, which in business terms is called minimum resale price maintenance. From the consumer’s perspective, the decision to buy which game is therefore not left on price.

On the question of pricing games itself, we are confused about how it works. Should anyone like to go into details of it, Dan Adelman has this interesting explanation on the pricing of indie games. Dan was part of the founding team of X-box and later at Nintendo. Without going into details, we’ll highlight two bits coming out of his blog:

Games are an experiential good – which means that unless a consumer experiences it, they can’t assign a value (read price) to it. This is perhaps why big gaming companies spend a ton of marketing money in promotions to build up hype.

This might be important for VCs in the mailing list. If you look at investing in gaming companies, we’d love to hear from you how you estimate future returns of a product, the price of which can only be determined after a user experiences it? Given this restraint, are you willing to place big bets on newer indie games that might come up?

Is the game a commodity or is there a substitute? – The price of rice/oil, a commodity, is set by the market because many are selling it. So if a developer is making another Ludo app in the market, they’d lose the ability to price the game. This is why game design and story design is so important for emerging gaming companies – to ensure it sets them apart and that there are no substitutes. This is also what is lacking so far in India. We’d like to know, what are the interesting games that you think are unique in India/ do not have a substitute?

Let us know what you think on Twitter/ Email.

Do you think someone you know might enjoy reading Turnaround? Forward this email to them or ask them to subscribe?